For most field sales teams, expenses are unavoidable. Travel, meals, local conveyance, stay, and market visits all come with costs. Yet, despite being a daily reality, expense claims are one of the most poorly managed processes in field sales operations.

In 2026, when organizations expect transparency, speed, and compliance, outdated expense claim workflows continue to slow teams down and create friction between sales, managers, and finance.

Let's look at how expense claim workflows actually work in sales teams and why automation has become essential.

Reality of Expense Claims in Field Sales

Unlike office teams, sales teams operate on the move. Expenses are incurred:

- Across different cities

- At different times

- Under different conditions

Traditionally, sales reps:

- Collect bills manually

- Note expenses in diaries or spreadsheets

- Submit claims at the end of the week or month

Managers then review these claims, often with limited context, and forward them to finance for processing.

On paper, this workflow seems simple. In reality, it creates delays, confusion, and disputes.

Limitations of Manual Expense Claim Workflows

1. Delayed Claim Submission

Sales reps often postpone submitting expenses because:

- Bills get misplaced

- Forms feel time-consuming

- There's no immediate reminder or structure

By the time claims are submitted, details are forgotten and supporting documents are incomplete.

2. Lack of Context for Managers

When a manager reviews a claim, they usually see:

- An amount

- A date

- A category

What they don't see is the context:

- Which market visit was this expense linked to?

- Was the rep actually on the field that day?

- Was the travel justified for the planned activity?

This lack of visibility makes approvals subjective and inconsistent.

3. Finance Teams Receive Incomplete Data

Finance teams depend on accurate, categorized, and policy-compliant data.

Manual workflows often result in:

- Incorrect expense categories

- Missing bills

- Policy violations discovered late

This leads to back-and-forth communication and delayed reimbursements.

Why Expense Claims Need a Structured Workflow?

Expense management is not just about reimbursement it's about control, compliance, and trust.

A structured expense claim workflow ensures:

- Expenses are captured when they occur

- Claims follow approval hierarchies

- Policies are enforced consistently

Expense workflows must work at the speed of field sales, not at the speed of paperwork.

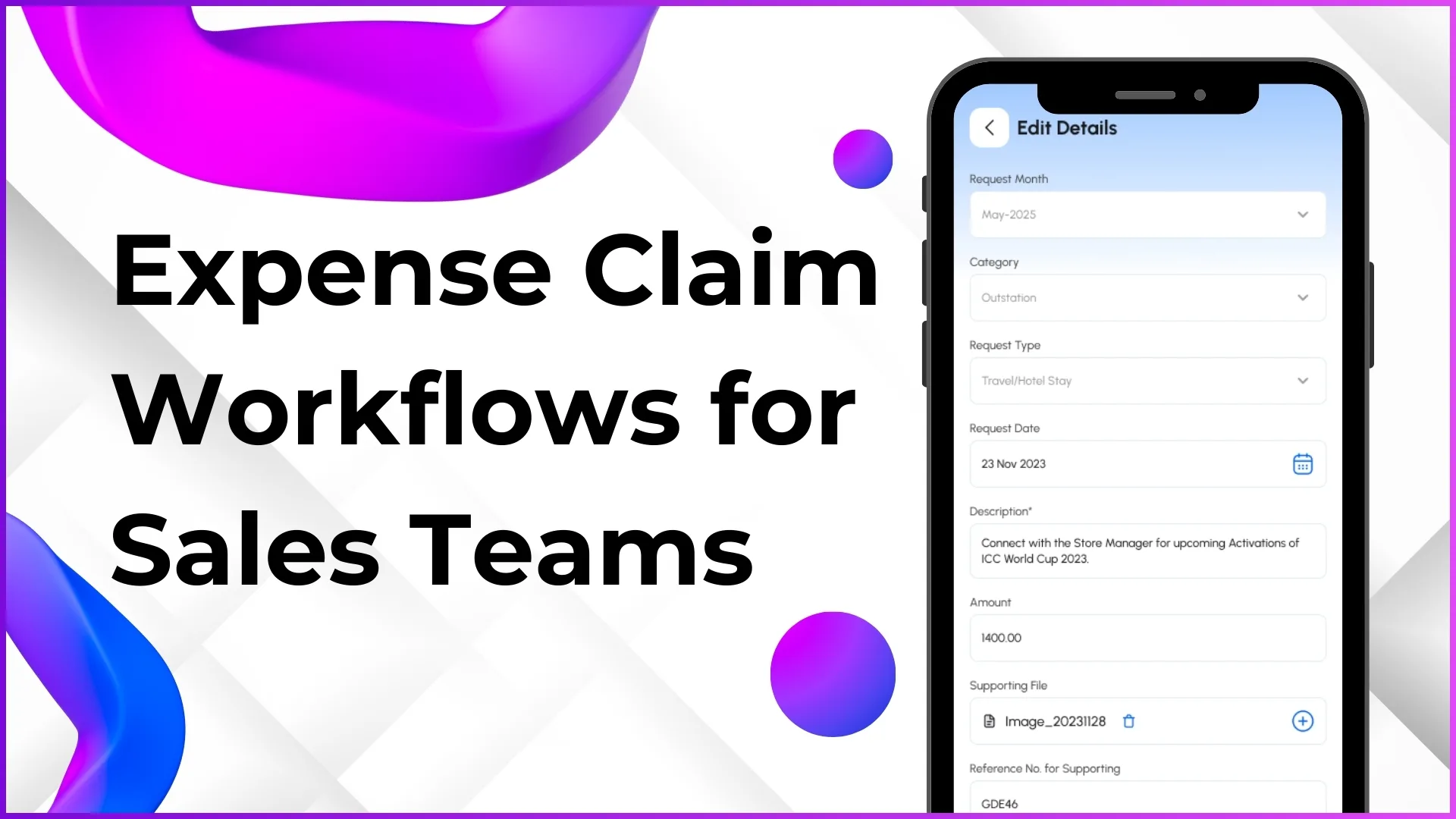

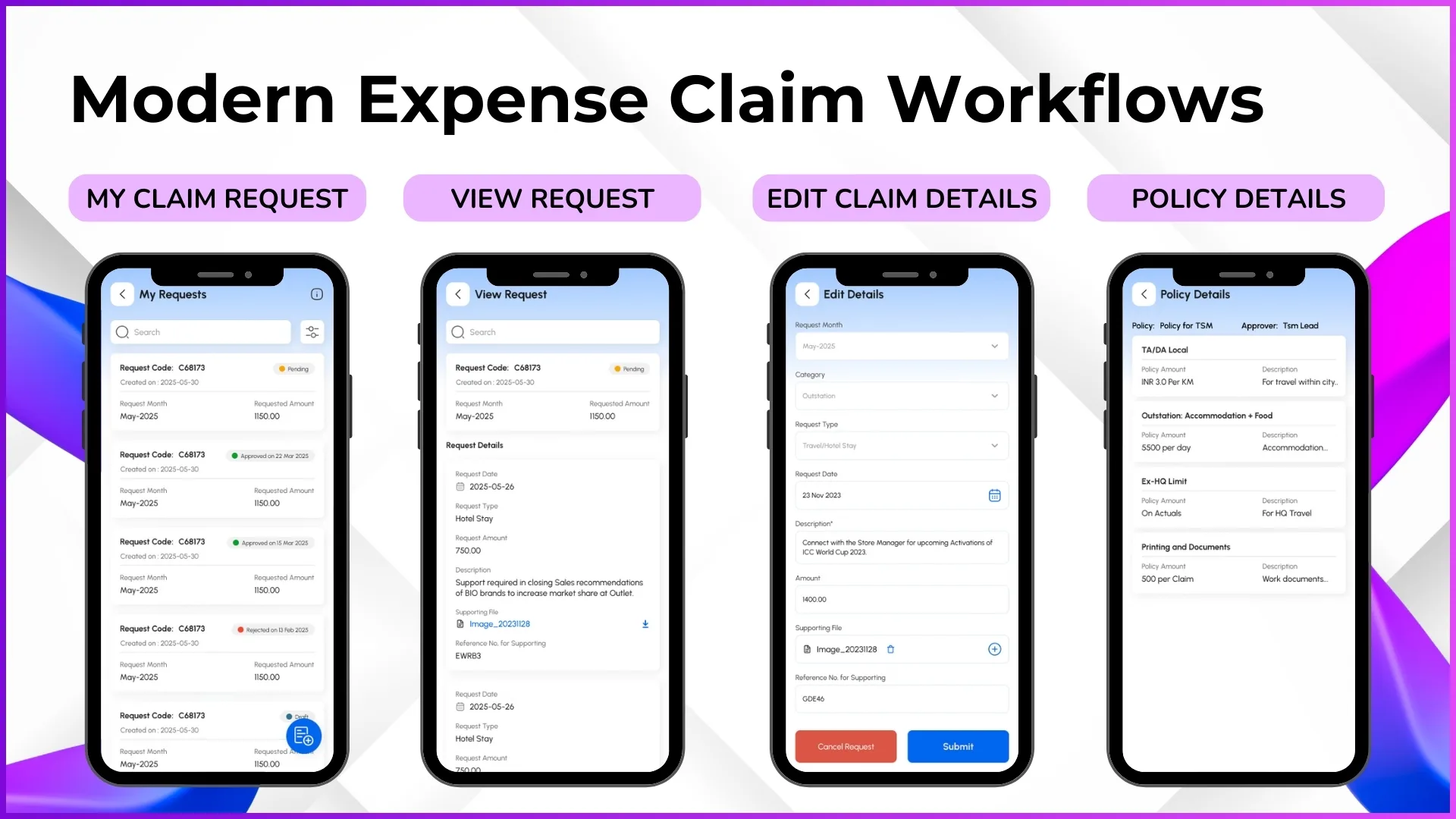

How Modern Expense Claim Workflows Work for Sales Teams

1. Expense Capture at the Source

Instead of waiting till the end of the week, sales reps log expenses:

- On the same day

- While the activity is still fresh

- With supporting bills attached immediately

This reduces errors and improves accuracy.

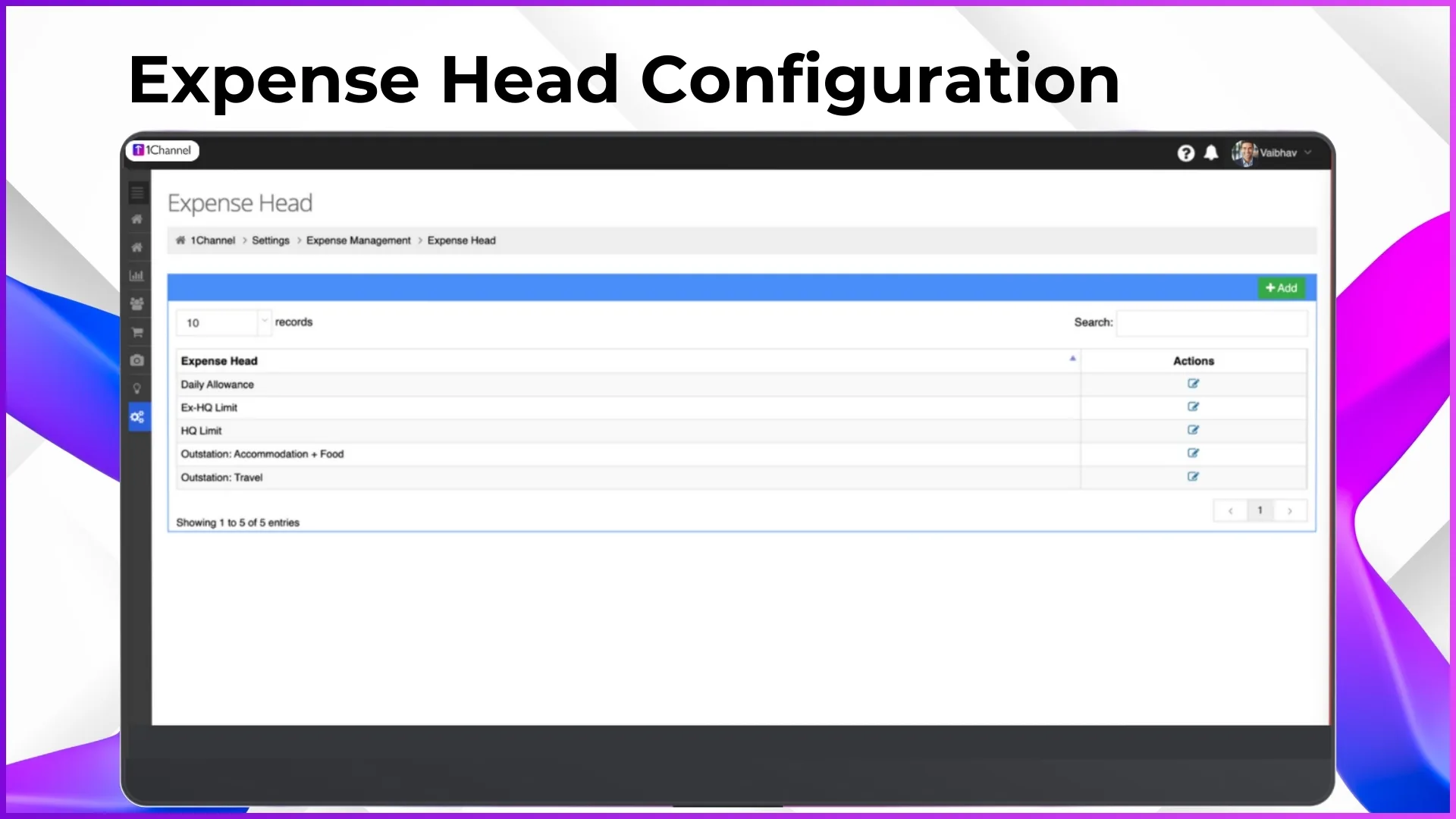

2. Automatic Policy Alignment

Modern workflows align expenses with:

- Pre-defined categories

- Daily or monthly limits

- Company travel and expense policies

If an expense exceeds limits or violates policy, it's flagged early before reaching finance.

3. Approval Based on Sales Hierarchy

Sales teams operate with clear reporting hierarchies.

Expense workflows follow the same structure:

- Claims move from sales rep to reporting manager

- Then to higher authorities if required

- Finally to finance

This ensures accountability without unnecessary delays.

Explore Expense Management Software

Control field expenses with automated policy enforcement, real-time tracking, and instant reimbursements. Prevent leakage without slowing down your teams.

Explore Expense Solutions →Real-World Example: A Typical Sales Expense Scenario

Consider a field sales executive visiting multiple outlets in a city:

- Travel expenses in the morning

- Lunch during market visits

- Local conveyance between stores

In a manual system, these expenses are bundled together later, often without clarity.

In a structured workflow:

- Each expense is logged separately

- Linked to the day's field activity

- Reviewed quickly with full visibility

Managers approve faster because they understand the context. Finance processes faster because the data is clean.

Visibility for Managers and Finance Teams

One of the biggest advantages of modern expense workflows is visibility.

Managers can:

- See pending, approved, and rejected claims

- Identify unusually high expenses

- Spot patterns across teams or regions

Finance teams can:

- Track reimbursement status

- Analyze expense trends

- Improve budget planning

This level of visibility is impossible with spreadsheets and emails.

Reducing Disputes and Building Trust

Expense claims are a common source of conflict:

- Reps feel reimbursements are delayed

- Managers feel claims are inflated

- Finance feels policies are ignored

A transparent workflow creates a single source of truth, reducing misunderstandings and improving trust across teams.

Why Expense Claim Automation Matters Today?

Businesses can no longer afford:

- Delayed reimbursements

- Policy violations

- Manual audits

- Unhappy field teams

Expense claim workflows must be:

- Fast

- Fair

- Verifiable

- Scalable

Automation ensures expenses are handled as part of daily sales operations not as an afterthought.

Explore Sales Force Automation

Empower your field teams with 1Channel's AI-powered SFA platform. Drive efficiency, boost sales, and gain real-time visibility across your entire sales operations.

Explore SFA Solutions →Final Thought

Expense claim workflows may seem like an operational detail, but for sales teams, they directly impact motivation, productivity, and trust.

When expense processes are slow or unclear, sales teams feel the friction immediately. When workflows are structured and transparent, teams stay focused on selling.

In 2026, efficient expense claim workflows are no longer a support function they are a core part of effective field sales operations.